What is a Transfer-on-Death Deed in Tennessee?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real property to a designated beneficiary upon the owner's death. This deed enables property owners to avoid probate, as the transfer occurs automatically without the need for court intervention.

Who can use a Transfer-on-Death Deed in Tennessee?

Any individual who holds title to real property in Tennessee can utilize a Transfer-on-Death Deed. This includes homeowners, landowners, and individuals with an interest in real estate. However, the property must be non-commercial, as the TOD Deed is intended for residential properties and vacant land.

How do I create a Transfer-on-Death Deed?

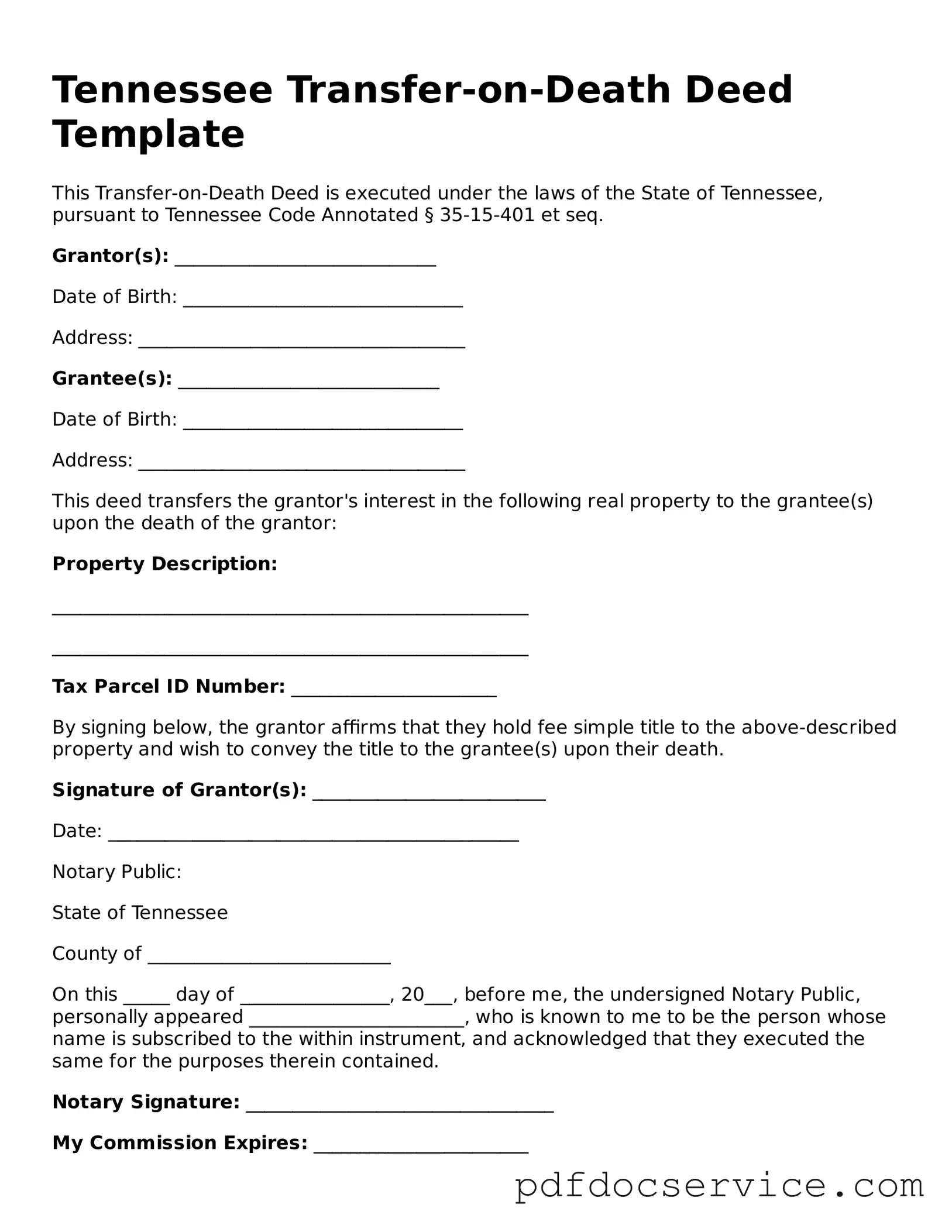

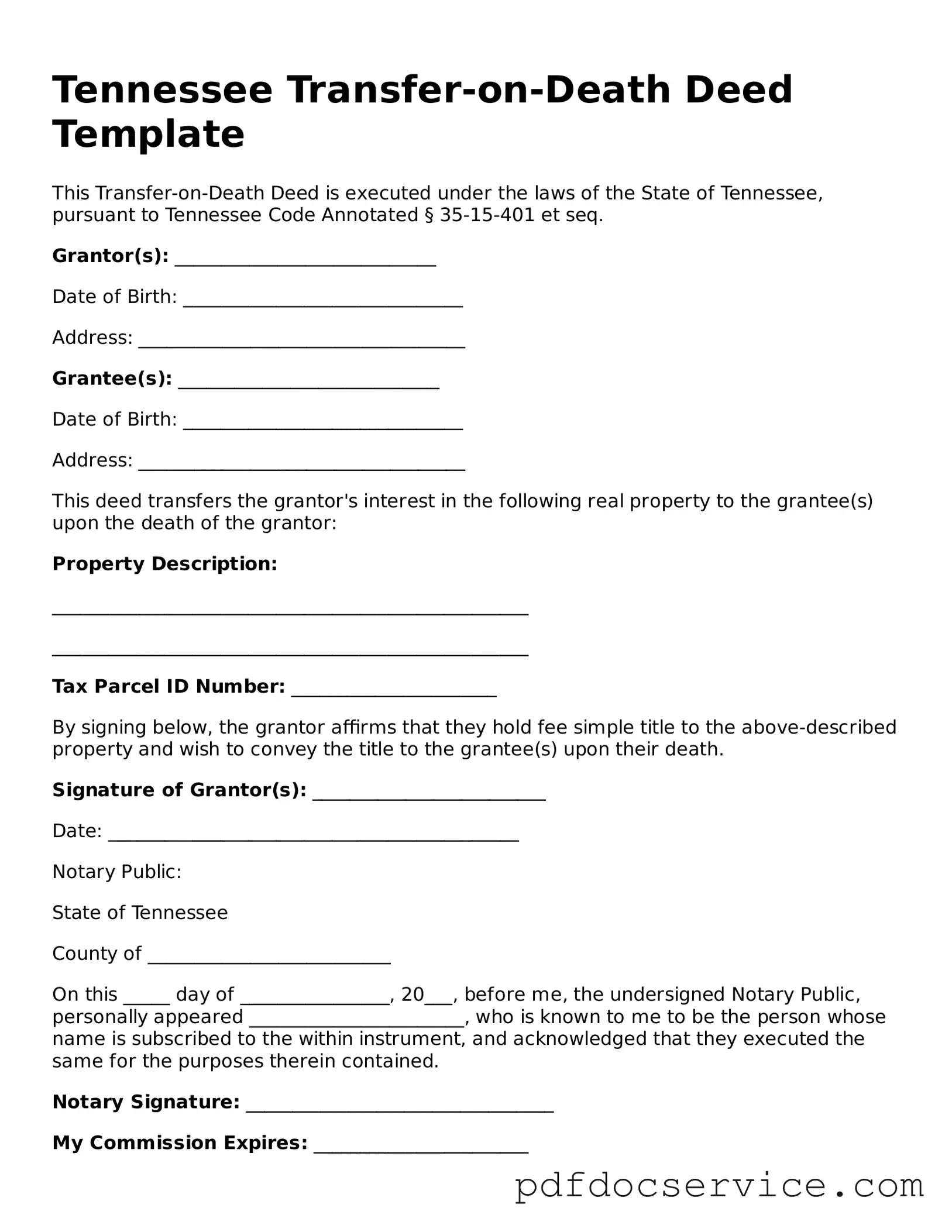

To create a Transfer-on-Death Deed in Tennessee, follow these steps:

-

Obtain the official form from the Tennessee Secretary of State's website or a legal resource.

-

Fill out the form with accurate information, including the property description and the beneficiary's details.

-

Sign the deed in the presence of a notary public.

-

Record the deed with the local county register of deeds office where the property is located.

Is there a cost associated with filing a Transfer-on-Death Deed?

Yes, there may be fees associated with recording the Transfer-on-Death Deed at the county register of deeds office. These fees can vary by county, so it is advisable to check with the local office for specific amounts.

Can I change or revoke a Transfer-on-Death Deed after it has been executed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time before the owner's death. To do this, the owner must execute a new deed or a formal revocation document, which must also be recorded with the county register of deeds office.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed becomes void concerning that beneficiary. The property owner can then designate a new beneficiary or allow the property to pass according to their will or Tennessee intestacy laws if no new beneficiary is named.

Are there any restrictions on who can be named as a beneficiary?

In Tennessee, beneficiaries can be individuals or entities, such as trusts or organizations. However, the property owner must ensure that the beneficiary is legally capable of receiving the property. For instance, minors may require a guardian or trustee to manage the property until they reach adulthood.

Does a Transfer-on-Death Deed affect the property owner’s ability to sell or mortgage the property?

No, a Transfer-on-Death Deed does not affect the property owner's rights to sell, mortgage, or otherwise manage the property during their lifetime. The owner retains full control over the property until death, at which point the transfer to the beneficiary occurs automatically.

Will a Transfer-on-Death Deed impact my taxes?

A Transfer-on-Death Deed typically does not affect property taxes during the owner’s lifetime. However, upon the owner's death, the property may be reassessed for tax purposes based on the current market value, which could result in changes to the tax liability for the beneficiary.

Is legal assistance necessary to create a Transfer-on-Death Deed?

While it is not legally required to seek assistance, consulting with a legal professional can be beneficial. An attorney can provide guidance on the implications of the deed, ensure that it complies with state laws, and help address any specific concerns related to the property or beneficiaries.