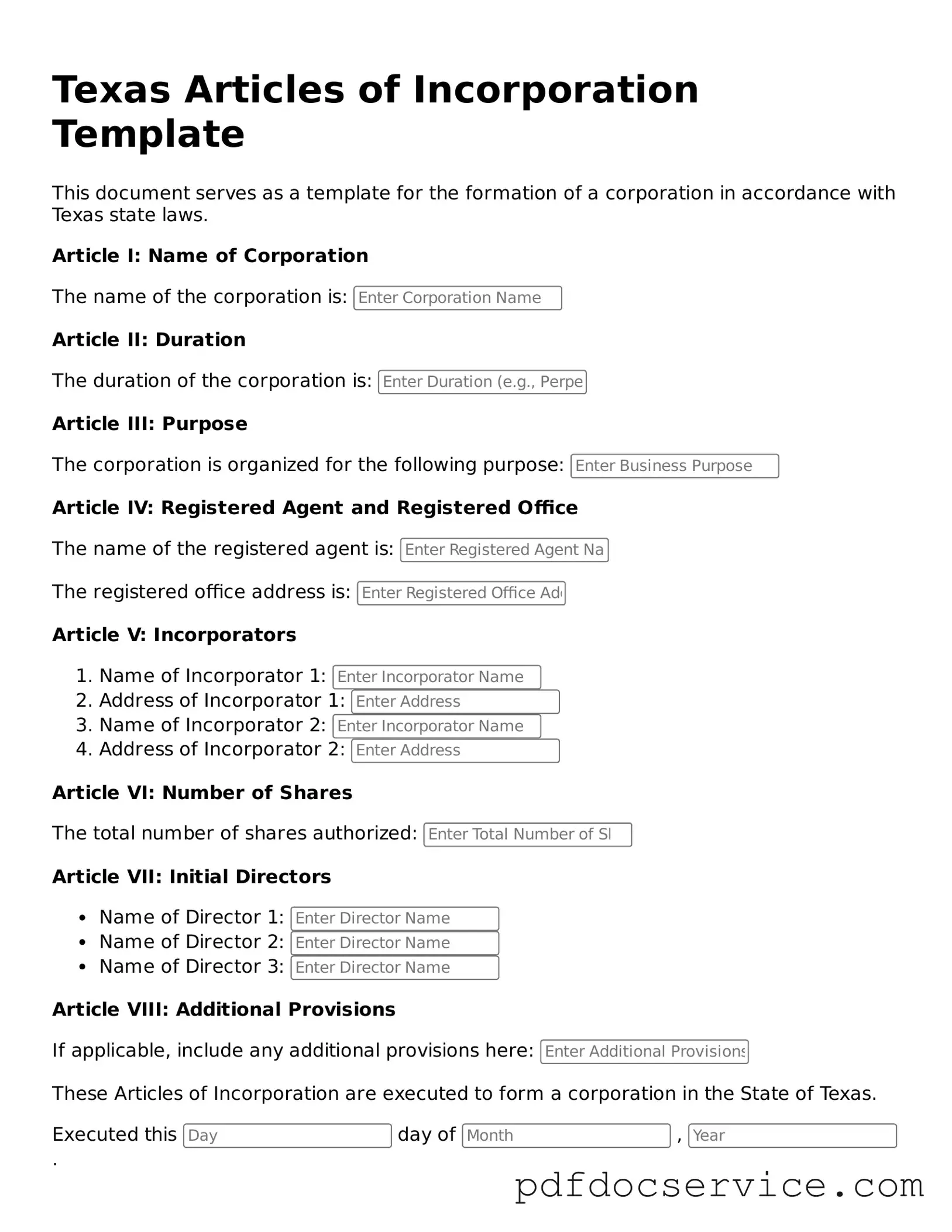

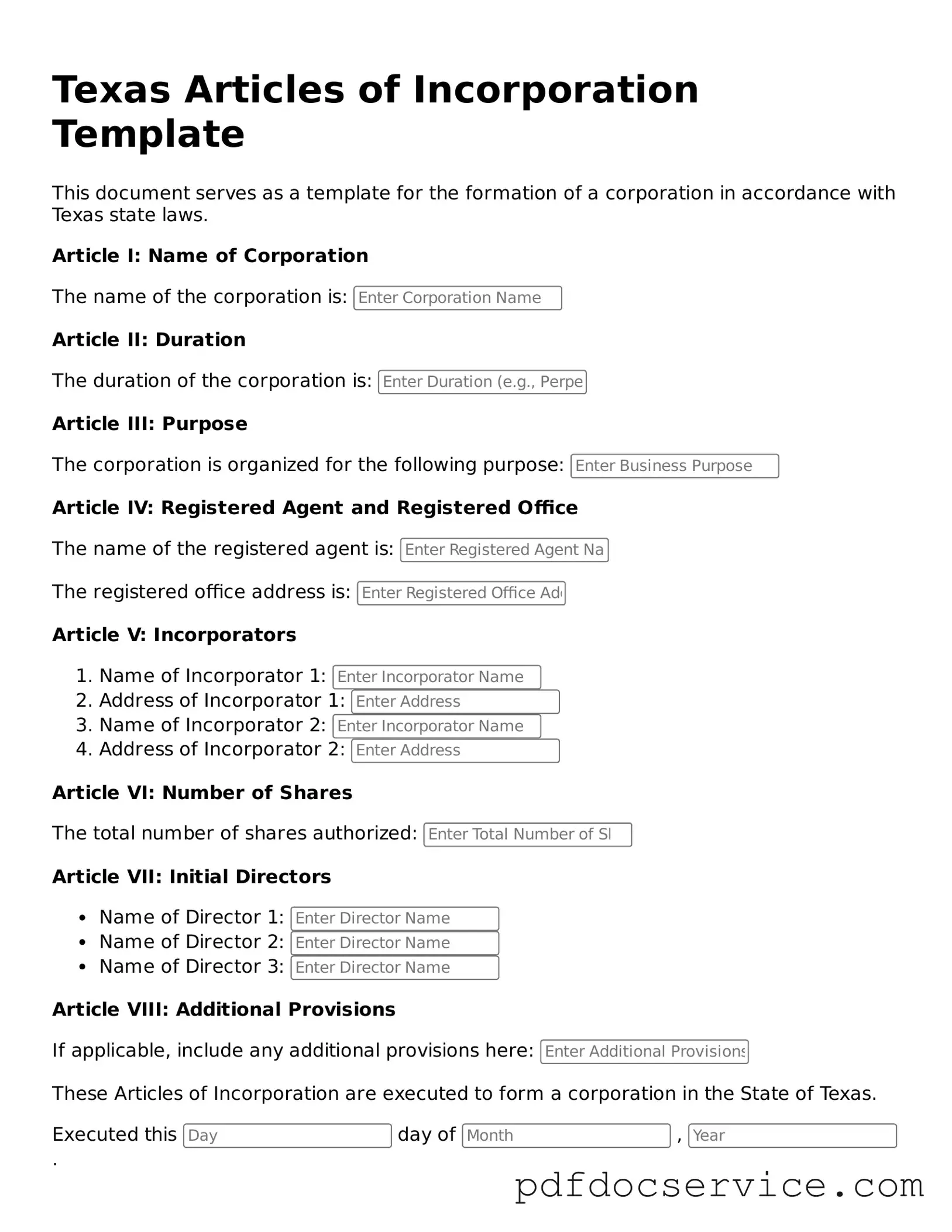

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in Texas. They outline the basic information about the corporation, such as its name, purpose, and the address of its registered office. Filing these documents is a crucial step in forming a corporation, as they provide the state with essential details about the entity.

What information is required to complete the Articles of Incorporation form?

To complete the Articles of Incorporation form in Texas, you will need to provide the following information:

-

The name of the corporation, which must be unique and not already in use.

-

The purpose of the corporation, which can be general or specific.

-

The address of the corporation's registered office, including the county.

-

The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

-

The number of shares the corporation is authorized to issue.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. If you choose to file online, visit the Texas Secretary of State's website. You will need to create an account and complete the online form. If you prefer to file by mail, print the form, fill it out, and send it to the appropriate address along with the required filing fee. Ensure that all information is accurate to avoid delays.

What is the filing fee for the Articles of Incorporation in Texas?

The filing fee for the Articles of Incorporation in Texas varies depending on the type of corporation you are forming. Generally, the fee ranges from $300 to $750. It is important to check the Texas Secretary of State's website for the most current fee schedule and payment options.

How long does it take for the Articles of Incorporation to be processed?

The processing time for Articles of Incorporation can vary. Typically, it takes about 3 to 5 business days for online filings to be processed. Mail filings may take longer, often up to 10 business days. If you need expedited processing, you can request it for an additional fee.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, you will receive a Certificate of Incorporation from the Texas Secretary of State. This document serves as official proof that your corporation is legally established. After receiving the certificate, you should take additional steps, such as obtaining an Employer Identification Number (EIN) from the IRS and setting up corporate bylaws.

Can I amend my Articles of Incorporation after they have been filed?

Yes, you can amend your Articles of Incorporation after they have been filed. Common reasons for amendments include changes to the corporation's name, address, or purpose. To make amendments, you must file a Certificate of Amendment with the Texas Secretary of State and pay the required fee. Ensure that you follow the proper procedures to maintain compliance with state regulations.