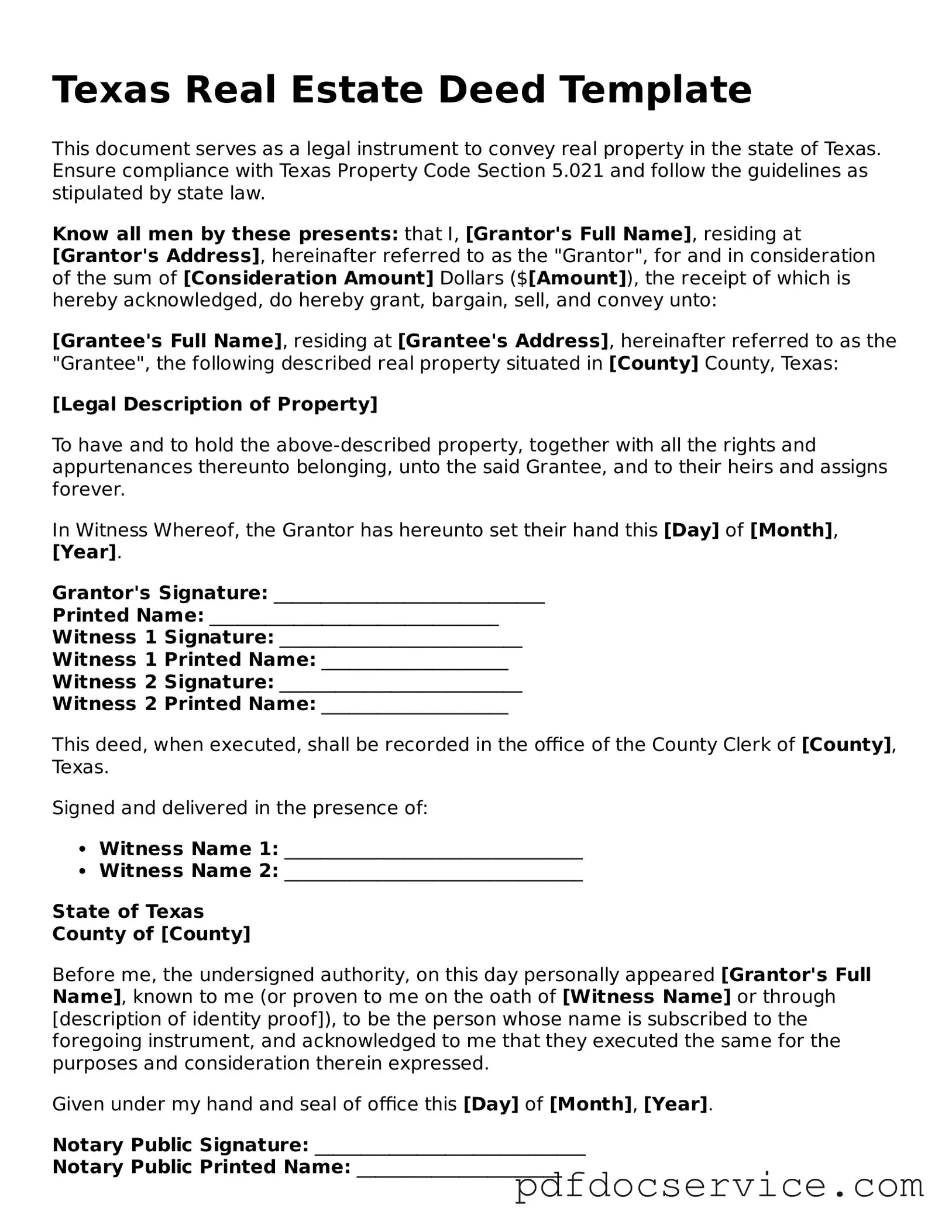

A Texas Deed form is a legal document used to transfer ownership of real estate property in the state of Texas. It serves as proof of the transfer and outlines the rights of the new property owner.

What types of deeds are available in Texas?

In Texas, several types of deeds can be used, including:

-

General Warranty Deed:

Offers the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property.

-

Special Warranty Deed:

Similar to a general warranty deed but only guarantees the title for the time the seller owned the property.

-

Quitclaim Deed:

Transfers whatever interest the seller has in the property without any guarantees or warranties.

-

Grant Deed:

Provides some level of assurance that the property is free from any encumbrances created by the seller.

The Texas Deed form must be signed by the property owner (the grantor) transferring the property. In some cases, the buyer (the grantee) may also sign, especially in transactions involving a loan or mortgage.

Do I need a notary for a Texas Deed?

Yes, a Texas Deed must be notarized to be legally binding. The notary verifies the identities of the signers and witnesses the signing of the document.

How do I file a Texas Deed?

To file a Texas Deed, follow these steps:

-

Complete the deed form accurately.

-

Have the document signed and notarized.

-

File the deed with the county clerk's office in the county where the property is located.

-

Pay any applicable filing fees.

A Texas Deed typically requires the following information:

-

The names of the grantor and grantee.

-

A legal description of the property.

-

The date of the transfer.

-

Any warranties or covenants provided by the grantor.

Can I create my own Texas Deed?

While it is possible to create your own Texas Deed, it is advisable to consult with a real estate attorney or a qualified professional. They can help ensure that the document is correctly formatted and contains all necessary legal language.

What happens if I don’t file the Texas Deed?

If you do not file the Texas Deed, the transfer of ownership may not be legally recognized. This could lead to complications in the future, such as disputes over property rights or difficulties in selling the property.

Is there a deadline for filing a Texas Deed?

While there is no strict deadline for filing a Texas Deed, it is recommended to file it as soon as possible after the transfer. Delaying the filing could result in issues related to property ownership and title clarity.

What should I do if I have more questions about Texas Deeds?

If you have further questions about Texas Deeds, consider reaching out to a real estate attorney or a local title company. They can provide expert guidance tailored to your specific situation.