What is a Texas Lady Bird Deed?

A Texas Lady Bird Deed is a legal document that allows property owners to transfer their real estate to their beneficiaries while retaining certain rights during their lifetime. This type of deed is unique because it enables the property owner to maintain control over the property, including the right to sell, lease, or mortgage it without the consent of the beneficiaries. Upon the owner's death, the property automatically transfers to the designated beneficiaries without going through probate.

What are the benefits of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed, including:

-

Avoidance of Probate:

The property transfers directly to the beneficiaries, bypassing the often lengthy and costly probate process.

-

Retained Control:

The property owner retains full control over the property during their lifetime, allowing for flexibility in managing the asset.

-

Tax Benefits:

The property may receive a step-up in basis for tax purposes upon the owner's death, potentially reducing capital gains taxes for the beneficiaries.

Who can use a Lady Bird Deed?

Any individual who owns real estate in Texas can utilize a Lady Bird Deed. This includes homeowners, landowners, and individuals with property interests. However, it is important to consider the implications of this deed in the context of one’s overall estate planning strategy.

What types of property can be transferred using a Lady Bird Deed?

A Lady Bird Deed can be used to transfer various types of real estate, including:

-

Single-family homes

-

Vacant land

-

Commercial properties

However, it cannot be used for personal property, such as vehicles or bank accounts.

Are there any restrictions or requirements for a Lady Bird Deed?

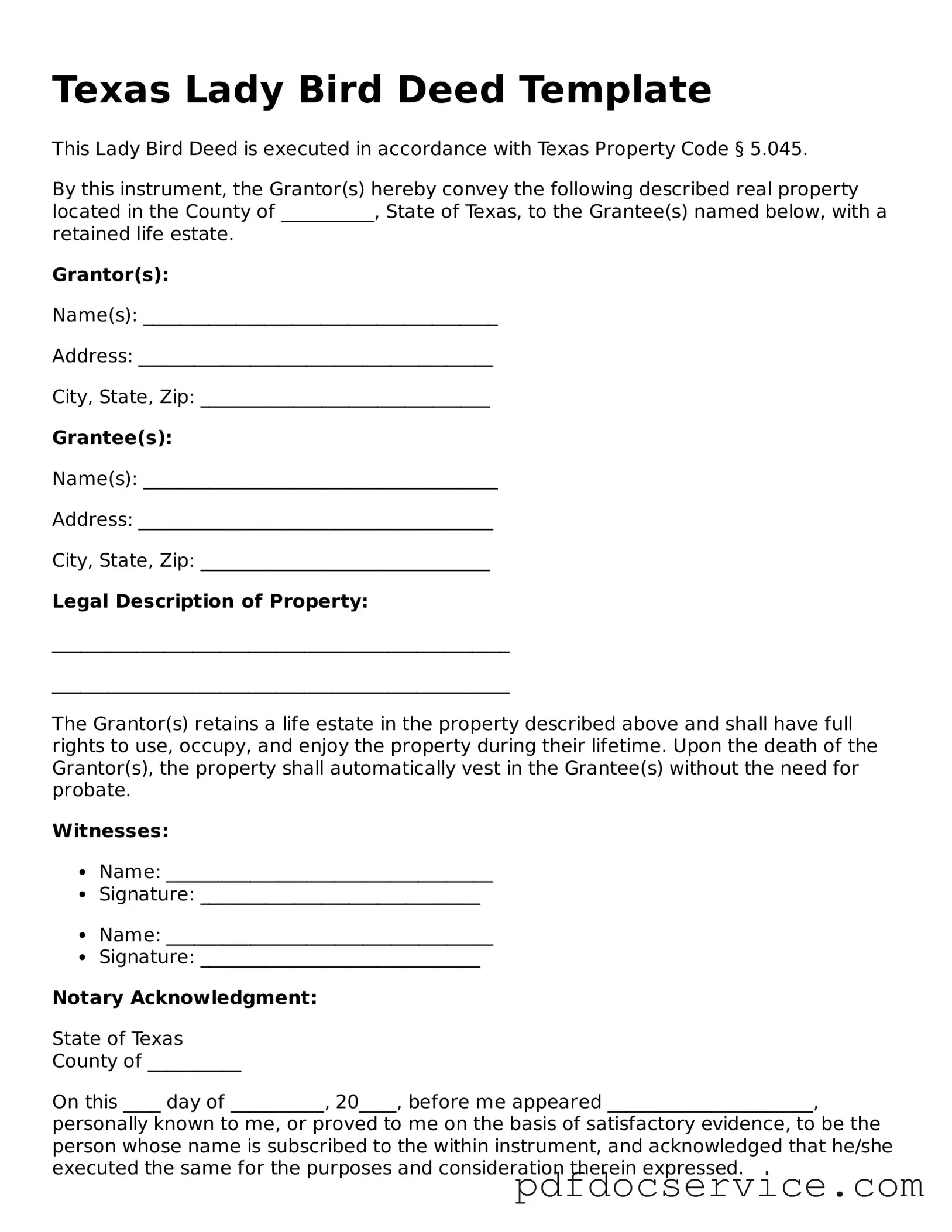

Yes, there are specific requirements for a Lady Bird Deed to be valid. The deed must:

-

Be in writing and signed by the property owner.

-

Clearly identify the property being transferred.

-

Designate the beneficiaries who will receive the property upon the owner's death.

-

Be recorded in the county where the property is located.

Failure to meet these requirements may result in the deed being deemed invalid.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time during the property owner's lifetime. The owner simply needs to execute a new deed that explicitly revokes the previous one or alters the beneficiaries. It is advisable to record the new deed to ensure clarity and prevent potential disputes.

Is legal assistance necessary to create a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without legal assistance, consulting with an attorney is highly recommended. An attorney can provide guidance on the implications of the deed, ensure compliance with legal requirements, and help integrate the deed into a broader estate plan. This can prevent issues that may arise later regarding property rights or beneficiary disputes.