What is a Texas Promissory Note?

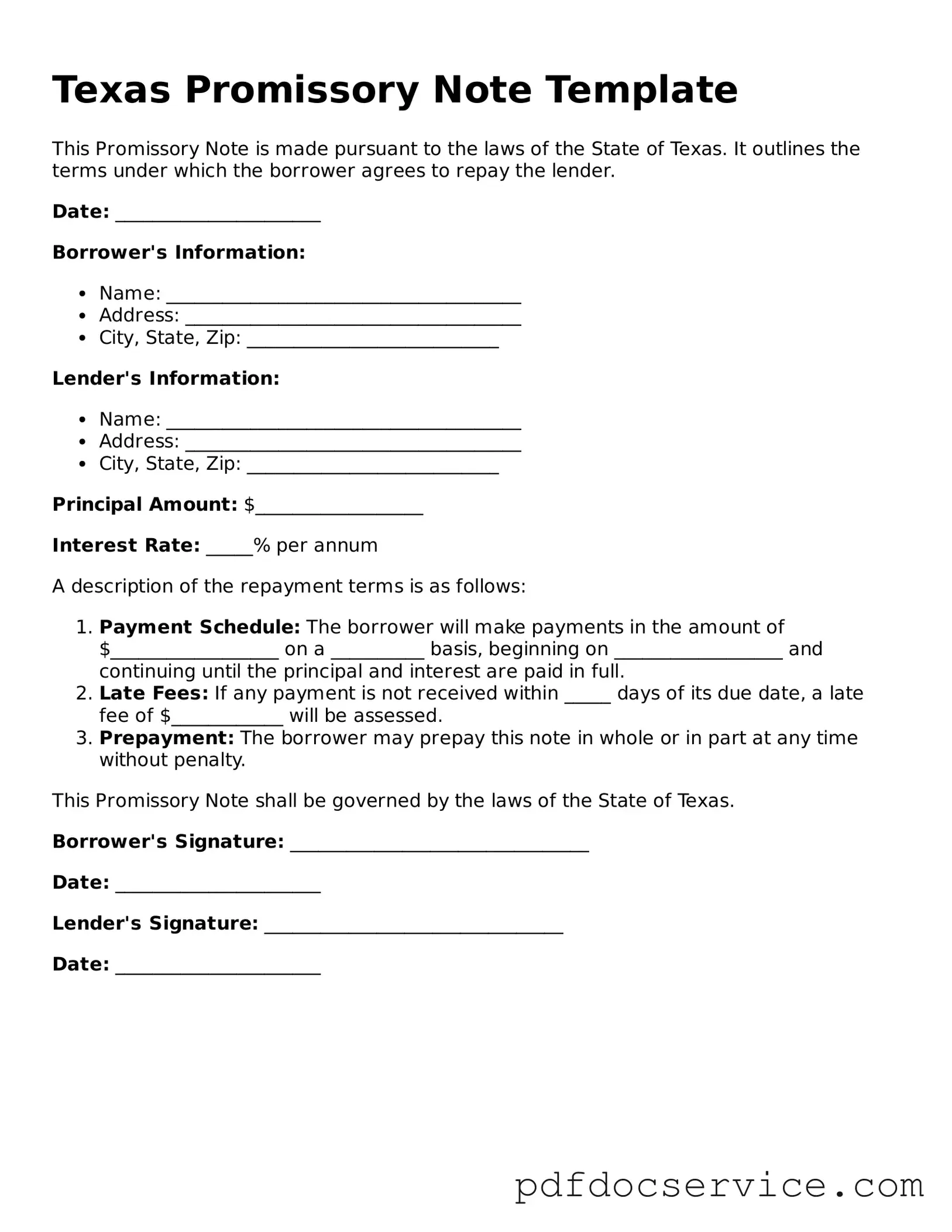

A Texas Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. It serves as a written record of the debt and includes details such as the loan amount, interest rate, payment schedule, and any applicable penalties for late payments.

Who can use a Texas Promissory Note?

Anyone can use a Texas Promissory Note, including individuals, businesses, and organizations. It is commonly utilized for personal loans, business loans, or any situation where one party lends money to another. Both the lender and borrower should be clear on the terms to avoid misunderstandings.

What are the key components of a Texas Promissory Note?

A well-drafted Texas Promissory Note typically includes the following components:

-

Principal Amount:

The total amount of money being borrowed.

-

Interest Rate:

The rate at which interest will accrue on the principal amount.

-

Payment Schedule:

Details on how and when payments will be made.

-

Maturity Date:

The date by which the loan must be fully repaid.

-

Default Terms:

Conditions that define what happens if the borrower fails to make payments.

-

Signatures:

Both parties must sign the document to make it legally binding.

Is a Texas Promissory Note legally binding?

Yes, a Texas Promissory Note is legally binding as long as it meets certain criteria. Both parties must agree to the terms, and the document must be signed by the borrower. It is advisable to have the note notarized to add an extra layer of authenticity and enforceability.

Can I modify a Texas Promissory Note after it has been signed?

Yes, modifications can be made to a Texas Promissory Note, but both parties must agree to the changes. It’s best to document any amendments in writing and have both parties sign the revised terms to ensure clarity and avoid future disputes.

What happens if the borrower defaults on the note?

If the borrower defaults, the lender has several options, which may include:

-

Charging late fees as outlined in the note.

-

Taking legal action to recover the owed amount.

-

Negotiating a new payment plan with the borrower.

It's important for both parties to understand the default terms outlined in the note to know their rights and responsibilities.

Do I need a lawyer to create a Texas Promissory Note?

While you can create a Texas Promissory Note without a lawyer, it is wise to consult one, especially for larger amounts or complex situations. A legal expert can help ensure that the note complies with Texas laws and adequately protects your interests.

Where can I find a template for a Texas Promissory Note?

Templates for Texas Promissory Notes can be found online through legal document websites, or you can consult with a lawyer for a customized version. Ensure that any template you use complies with Texas law and suits your specific needs.

How do I enforce a Texas Promissory Note?

To enforce a Texas Promissory Note, the lender may need to take legal action if the borrower fails to repay. This typically involves filing a lawsuit in the appropriate court. Having a signed and clear note will strengthen the lender's case. Always consider seeking legal advice before proceeding with enforcement actions.