What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document used to transfer ownership of real property from one person to another. Unlike a warranty deed, a quitclaim deed does not guarantee that the grantor has clear title to the property. Instead, it simply conveys whatever interest the grantor has, if any. This type of deed is often used among family members or in situations where the parties trust each other.

When should I use a Quitclaim Deed in Texas?

Quitclaim Deeds are commonly used in various situations, such as:

-

Transferring property between family members, like in a divorce settlement or inheritance.

-

Clearing up title issues when the ownership history is unclear.

-

Adding or removing someone from the title of a property.

-

Transferring property into a trust.

However, it’s essential to assess the circumstances carefully, as this deed does not provide any warranties regarding the property's title.

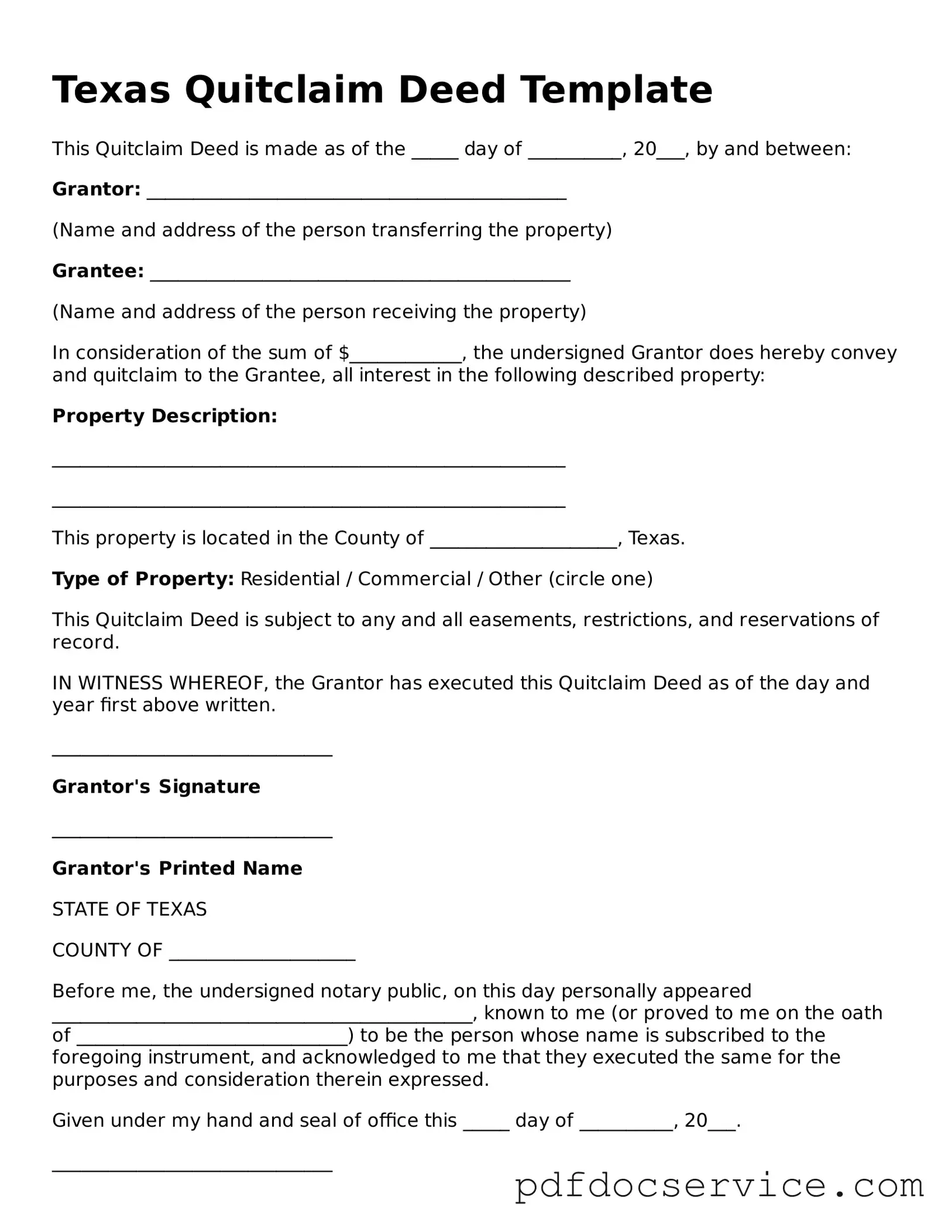

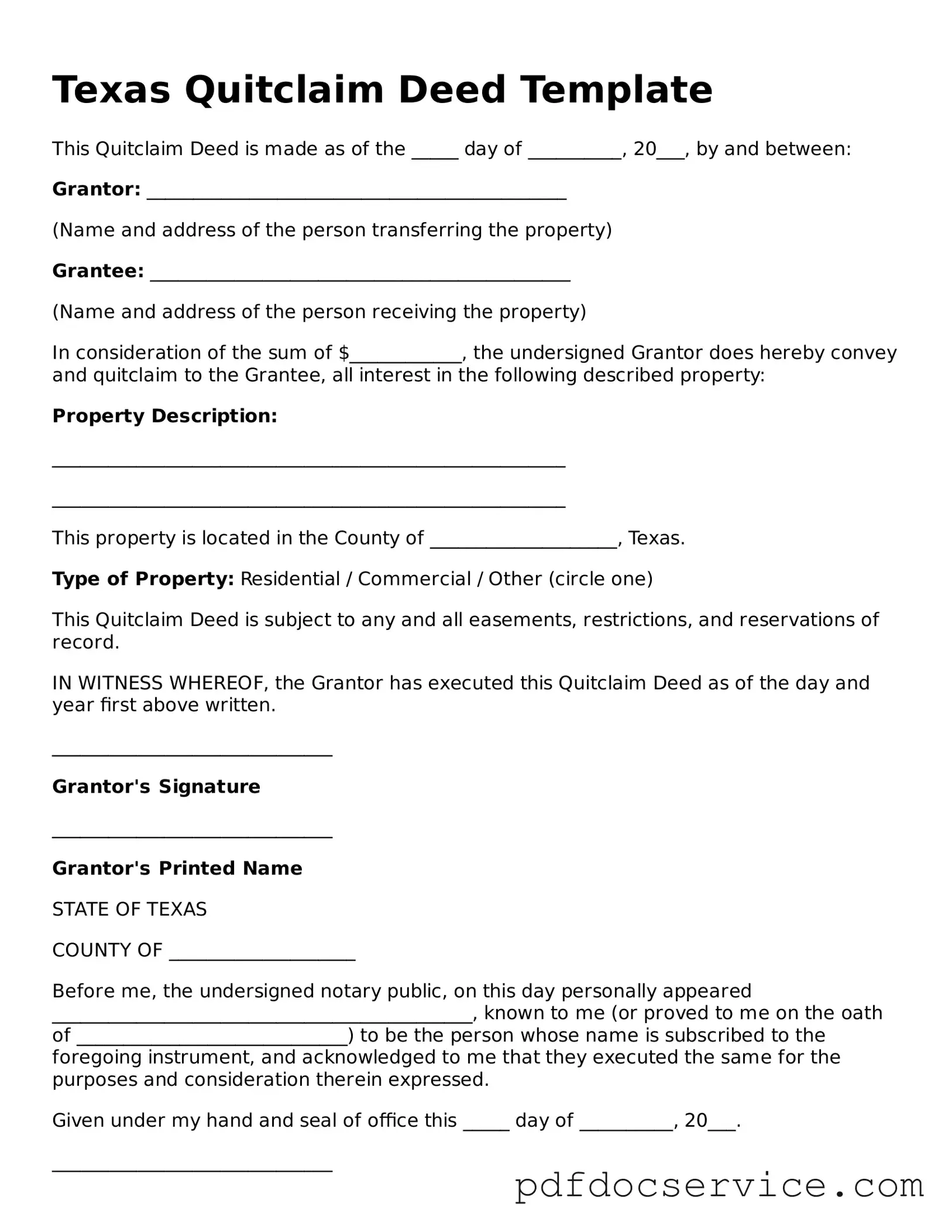

How do I complete a Quitclaim Deed in Texas?

Completing a Quitclaim Deed involves several steps:

-

Gather the necessary information, including the names of the grantor (the person transferring the property) and grantee (the person receiving the property).

-

Clearly describe the property being transferred, including its legal description.

-

Fill out the form accurately, ensuring all information is correct.

-

Sign the document in the presence of a notary public to validate the transfer.

After completing the deed, it must be filed with the county clerk’s office where the property is located to make the transfer official.

Are there any fees associated with filing a Quitclaim Deed in Texas?

Yes, there are typically fees for filing a Quitclaim Deed. These fees vary by county, so it's important to check with your local county clerk's office for the exact amount. Additionally, there may be other costs involved, such as notary fees if you require notarization of the document.

Do I need an attorney to prepare a Quitclaim Deed?

While it's not a legal requirement to have an attorney prepare a Quitclaim Deed, consulting with one can be beneficial. An attorney can ensure that the deed is filled out correctly and that all legal requirements are met. This can help avoid potential issues down the line, especially if there are complexities involved in the property transfer.

What happens after I file a Quitclaim Deed?

Once the Quitclaim Deed is filed with the county clerk, it becomes part of the public record. The grantee is now recognized as the new owner of the property, although the deed does not guarantee that the title is free from claims or liens. It’s a good idea for the grantee to conduct a title search to confirm the status of the property’s title and address any potential issues that may arise.