What is a Transfer-on-Death Deed in Texas?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Texas to transfer real estate to a designated beneficiary upon their death. This deed avoids probate, meaning the property can pass directly to the beneficiary without going through the lengthy court process.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in Texas can use a Transfer-on-Death Deed. This includes homeowners, landowners, and even those who own property jointly with others. However, it's important to ensure that the deed is executed correctly to be valid.

How do I create a Transfer-on-Death Deed?

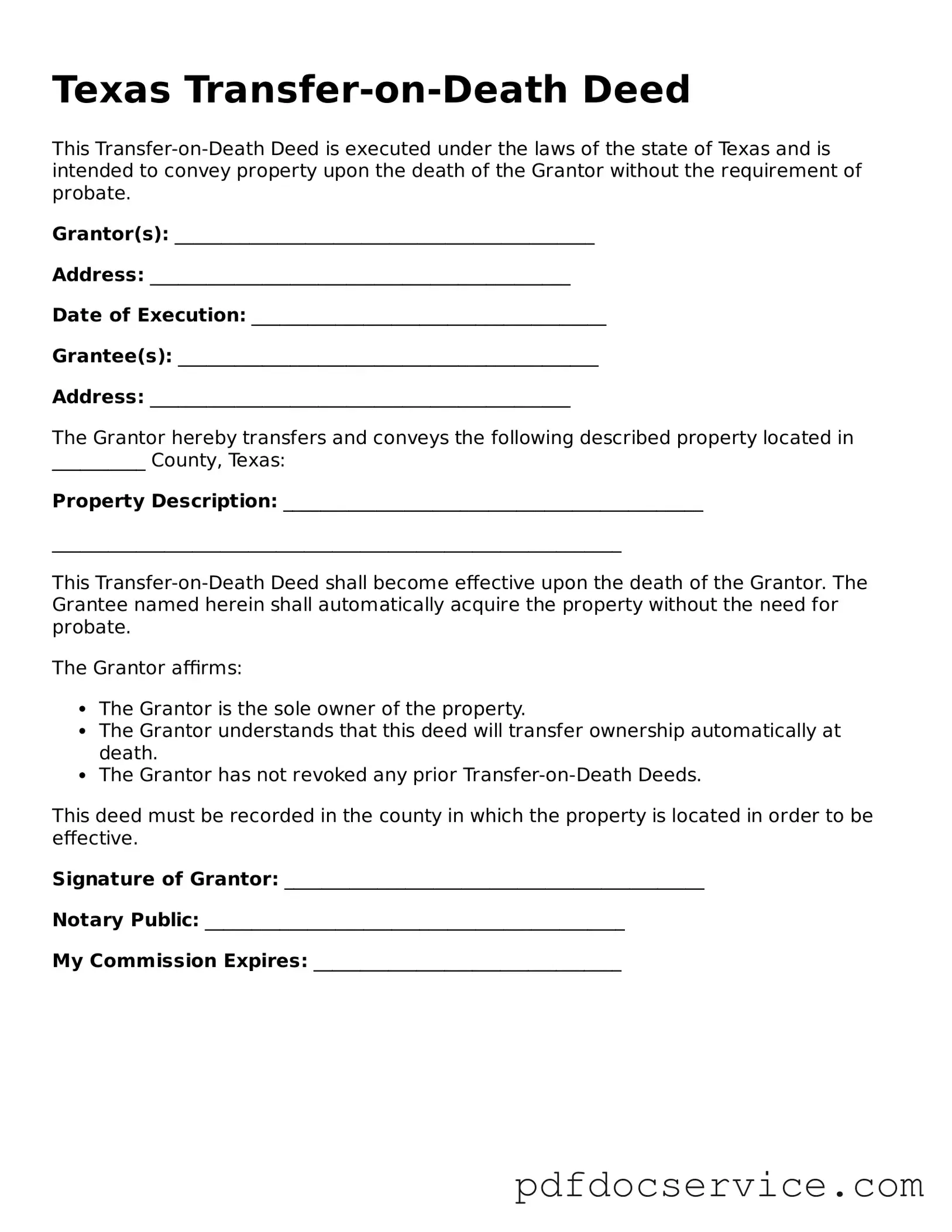

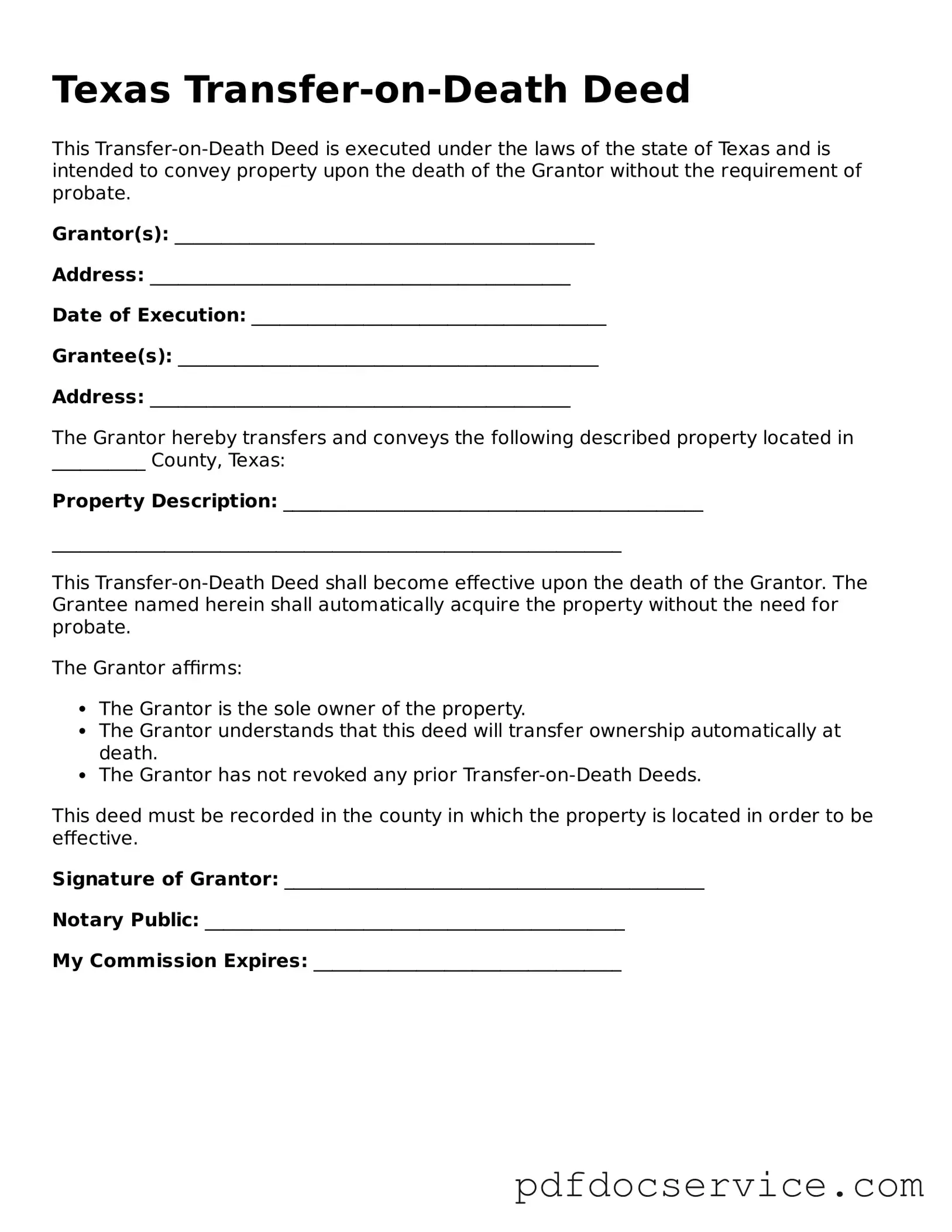

To create a TODD, follow these steps:

-

Obtain the appropriate form for a Transfer-on-Death Deed in Texas.

-

Fill out the form with your information, the property details, and the beneficiary's name.

-

Sign the deed in front of a notary public.

-

Record the deed with the county clerk's office where the property is located.

Ensure that all details are accurate to avoid issues later on.

Is there a cost associated with filing a Transfer-on-Death Deed?

Yes, there may be costs involved. While creating the deed itself may not require payment, you will need to pay a fee to record the deed with the county clerk's office. The fee varies by county, so it’s best to check with your local office for the exact amount.

Can I change or revoke a Transfer-on-Death Deed after it is filed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed or a revocation document and file it with the county clerk. Make sure to follow the same recording process to ensure your changes are valid.

What happens if the beneficiary dies before the property owner?

If the beneficiary named in the Transfer-on-Death Deed dies before the property owner, the deed becomes void. To avoid complications, it’s advisable to name alternate beneficiaries in the deed. This ensures that the property can still be transferred smoothly.

Are there any restrictions on who I can name as a beneficiary?

Generally, you can name anyone as a beneficiary, including family members, friends, or even charities. However, if the beneficiary is a minor, you may want to consider establishing a trust to manage the property until they are of legal age.

Do I need a lawyer to create a Transfer-on-Death Deed?

While it is not legally required to have a lawyer, consulting one is highly recommended. A lawyer can help ensure that the deed is completed correctly and meets all legal requirements. This can prevent potential issues or disputes in the future.