What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer ownership of real estate to a designated beneficiary upon their death. This deed bypasses the probate process, making it a popular choice for those looking to streamline the transfer of their property after passing.

How does a Transfer-on-Death Deed work?

When the owner of a property executes a TOD Deed, they retain full control of the property during their lifetime. The beneficiary named in the deed does not have any rights to the property until the owner passes away. At that point, the property automatically transfers to the beneficiary without the need for probate.

Who can be a beneficiary of a Transfer-on-Death Deed?

Beneficiaries can be individuals, such as family members or friends, or entities, like trusts or organizations. However, it is essential to ensure that the beneficiary is legally capable of inheriting the property, which typically means they must be of legal age and mentally competent.

Are there any limitations on the property that can be transferred using a TOD Deed?

Yes, not all properties can be transferred using a TOD Deed. Generally, the deed can only be used for residential real estate, such as single-family homes or condos. Additionally, properties that are subject to certain liens or are part of a trust may not be eligible for this type of transfer.

What are the benefits of using a Transfer-on-Death Deed?

-

Avoids probate:

One of the most significant advantages is that it allows for a seamless transfer of property without going through the often lengthy and costly probate process.

-

Retains control:

The property owner maintains full control of the property during their lifetime and can change or revoke the deed if circumstances change.

-

Simple process:

Creating a TOD Deed is generally straightforward and does not require the same level of legal formalities as a will.

Can I change the beneficiary after executing a Transfer-on-Death Deed?

Yes, the property owner can change the beneficiary at any time before their death. To do this, they would need to execute a new TOD Deed that designates the new beneficiary and record it with the appropriate local office. It is important to ensure that the previous deed is revoked to avoid confusion.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary passes away before the property owner, the transfer of the property may become complicated. Typically, the property would not automatically transfer to the deceased beneficiary's heirs unless specified in the TOD Deed. It is advisable to name alternate beneficiaries to prevent any issues.

Is a Transfer-on-Death Deed revocable?

Yes, a TOD Deed is revocable. The property owner can revoke the deed at any time during their lifetime. This can be done by executing a formal revocation document and recording it with the same office where the original deed was filed. This flexibility allows property owners to adapt their estate plans as needed.

Do I need a lawyer to create a Transfer-on-Death Deed?

While it is not legally required to have a lawyer draft a TOD Deed, consulting with one is highly recommended. A legal professional can ensure that the deed complies with state laws and accurately reflects the property owner's intentions, reducing the risk of future disputes.

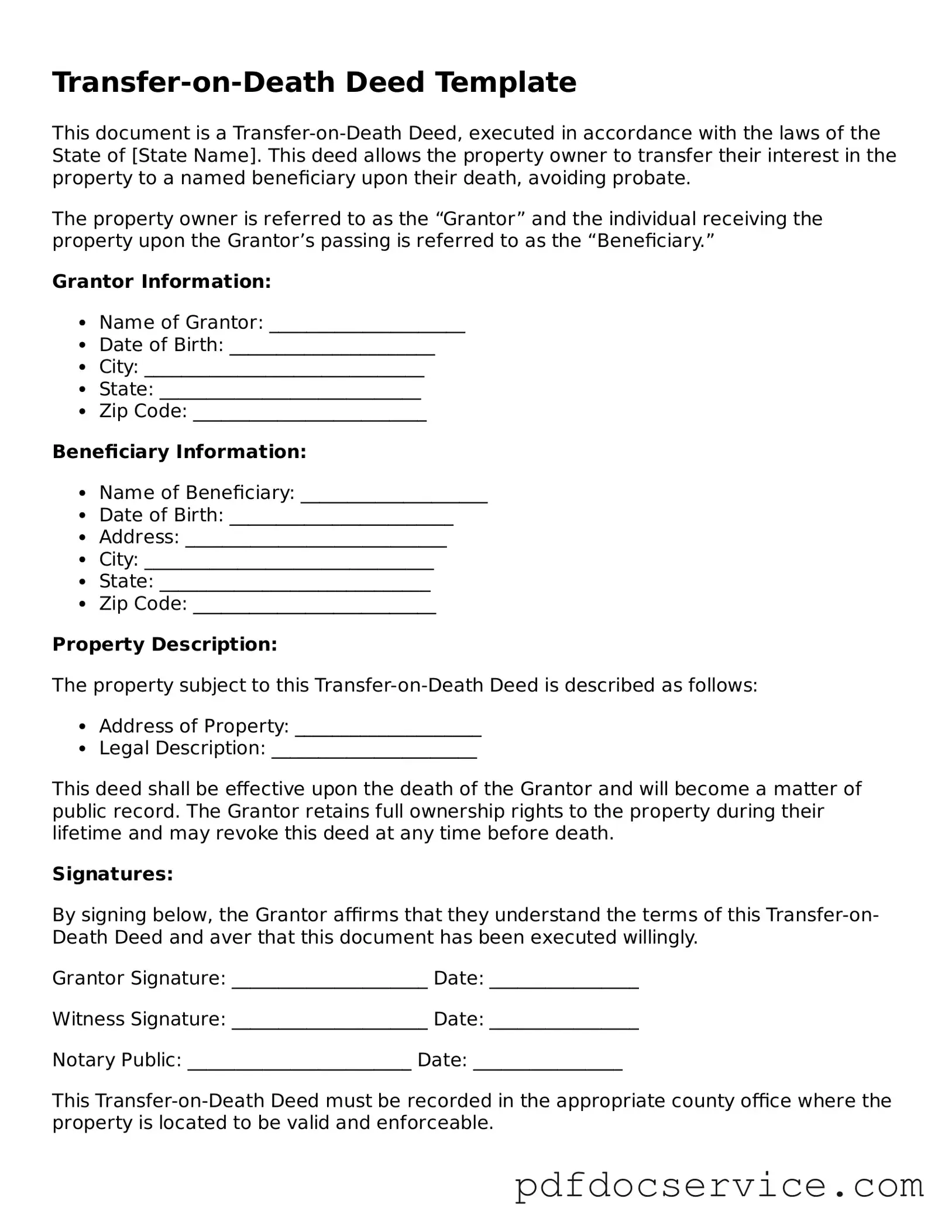

How do I file a Transfer-on-Death Deed?

To file a TOD Deed, the property owner must complete the deed form, which typically includes details about the property and the designated beneficiary. After signing the deed, it must be recorded with the local county recorder's office where the property is located. It is crucial to follow the specific recording requirements of your state to ensure the deed is valid.