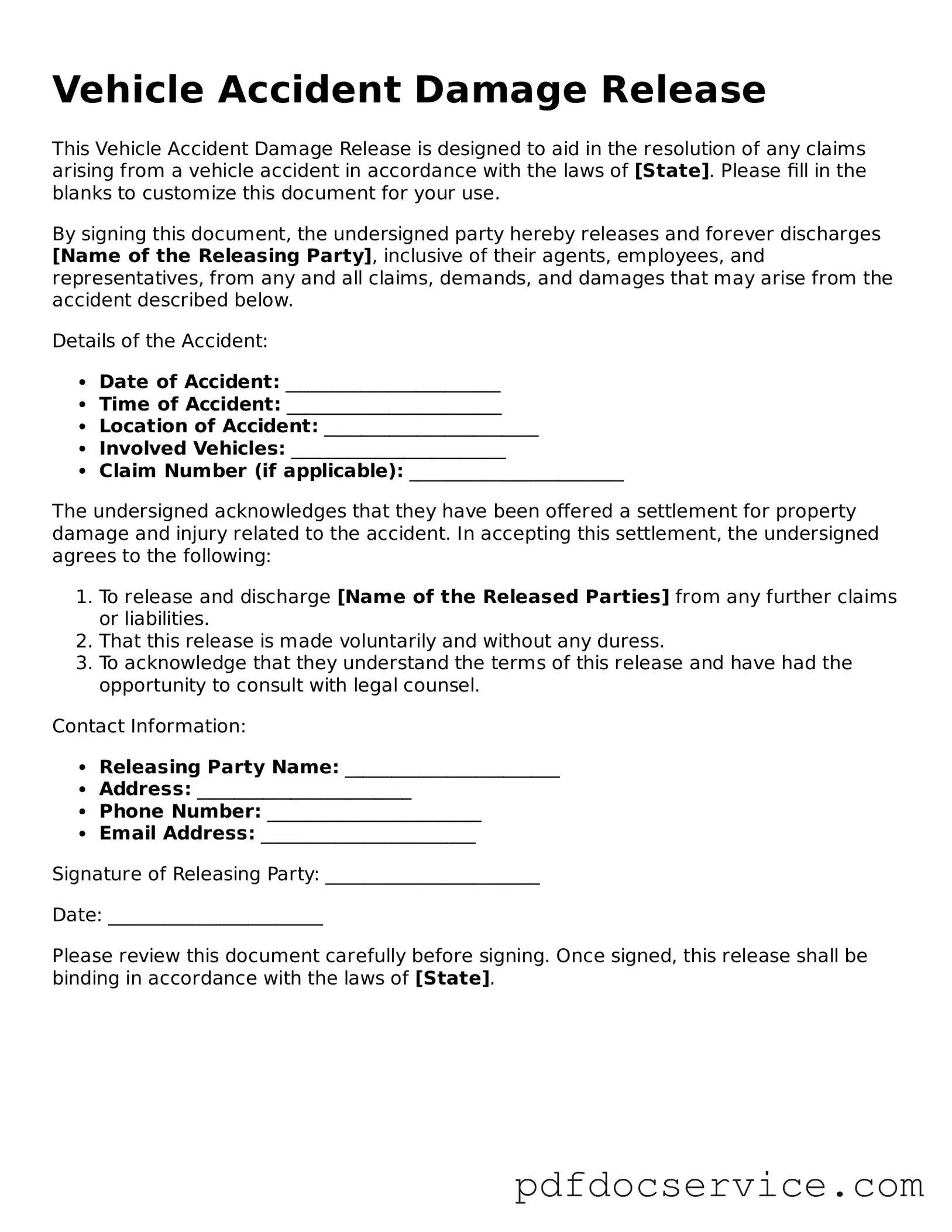

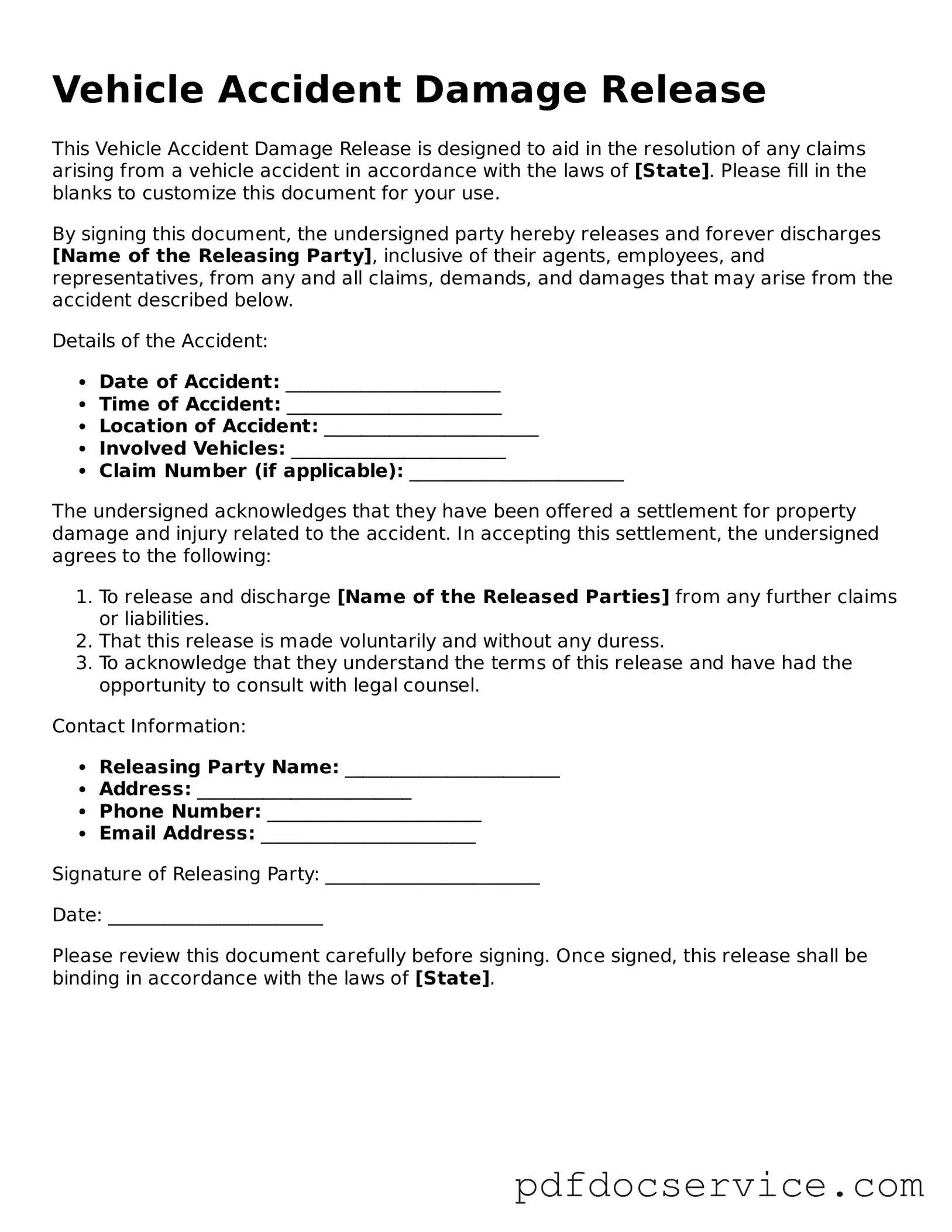

Blank Vehicle Accident Damage Release Form

The Vehicle Accident Damage Release form is a legal document that allows one party to release another from liability for damages resulting from a vehicle accident. This form is often used to settle claims quickly and avoid lengthy disputes. Understanding its purpose and implications is crucial for anyone involved in a vehicle accident.

Open Vehicle Accident Damage Release Editor

Blank Vehicle Accident Damage Release Form

Open Vehicle Accident Damage Release Editor

Open Vehicle Accident Damage Release Editor

or

Get Vehicle Accident Damage Release PDF

Finish the form now and be done

Finish Vehicle Accident Damage Release online using simple edit, save, and download steps.