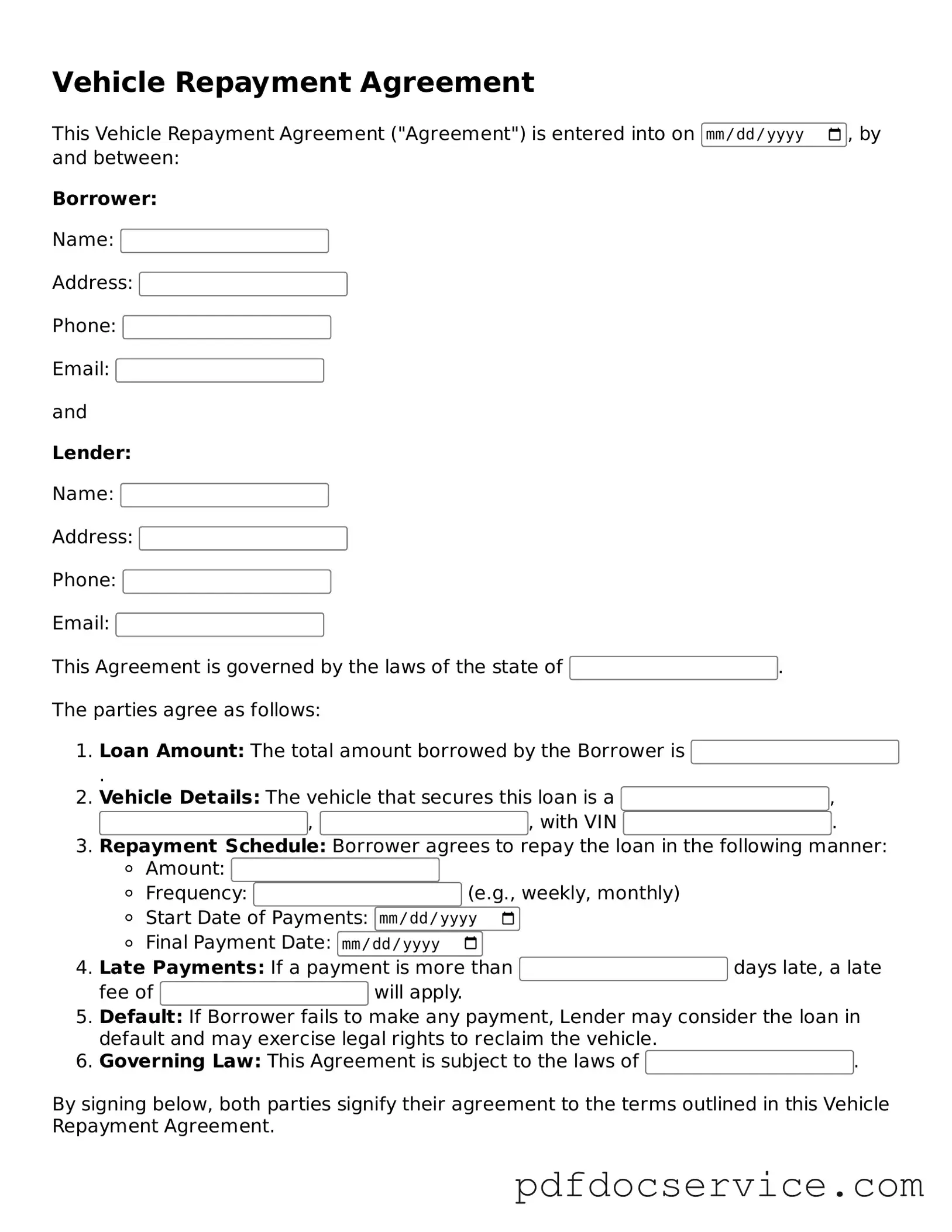

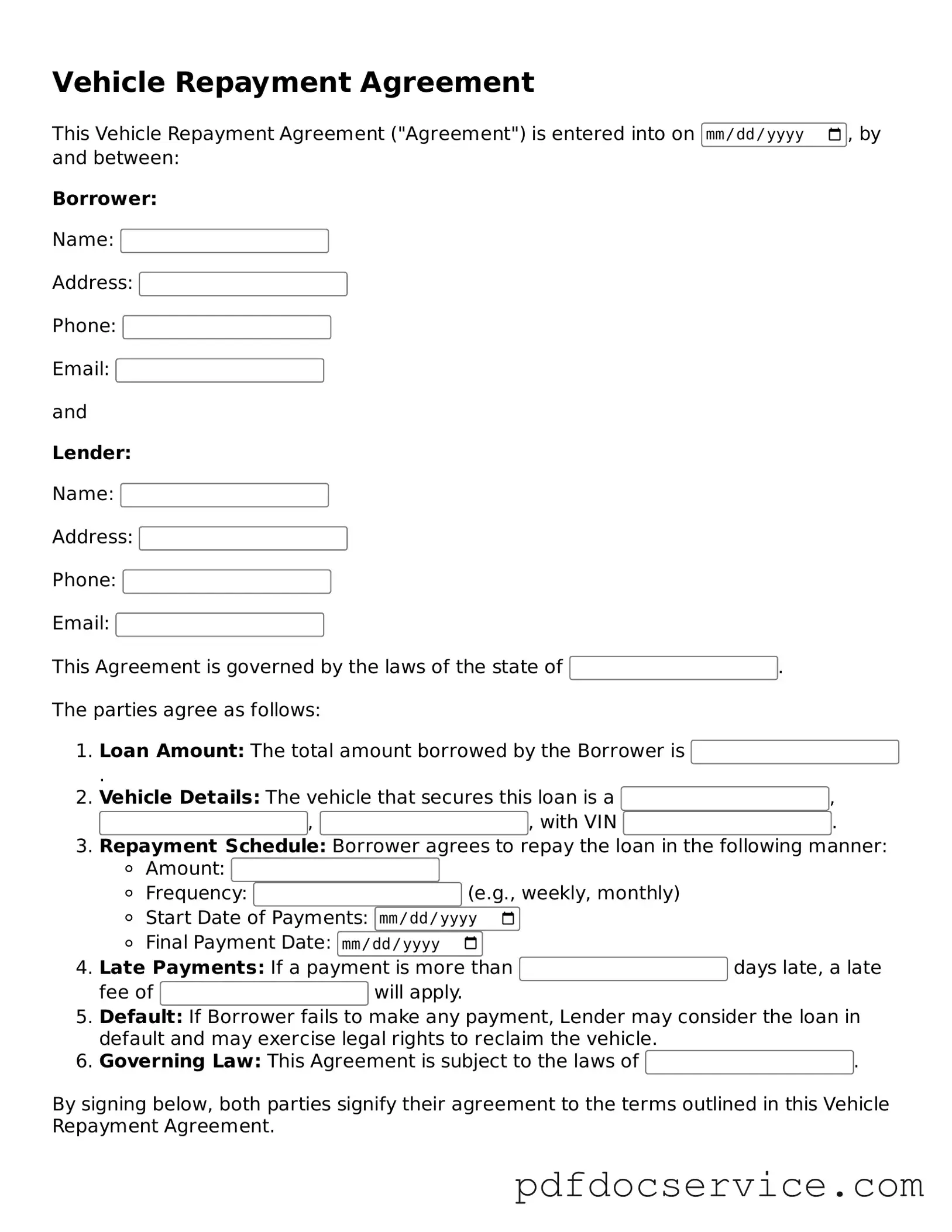

Blank Vehicle Repayment Agreement Form

A Vehicle Repayment Agreement form is a legal document that outlines the terms and conditions for repaying a loan taken out to purchase a vehicle. This agreement protects both the lender and the borrower by clearly stating the repayment schedule, interest rates, and any penalties for late payments. Understanding this form is crucial for anyone involved in financing a vehicle.

Open Vehicle Repayment Agreement Editor

Blank Vehicle Repayment Agreement Form

Open Vehicle Repayment Agreement Editor

Open Vehicle Repayment Agreement Editor

or

Get Vehicle Repayment Agreement PDF

Finish the form now and be done

Finish Vehicle Repayment Agreement online using simple edit, save, and download steps.